Net Present Value (NPV) is a key financial metric used to evaluate the profitability of an investment. Excel simplifies NPV calculations by providing built-in formulas and the ability to customize cash flow analysis. At The Coding College, we’ll guide you through the process step by step.

What is NPV?

NPV represents the difference between the present value of cash inflows and the present value of cash outflows over a period. It helps you determine whether a project is profitable, considering the time value of money.

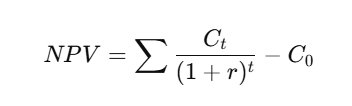

Formula for NPV:

Where:

- CtC_t = Cash inflow/outflow at time tt.

- rr = Discount rate or required rate of return.

- C0C_0 = Initial investment.

Why Use Excel for NPV Calculations?

Excel automates complex calculations, reducing errors and saving time. It provides the NPV function, which simplifies the calculation process.

Steps to Calculate NPV in Excel

Example Scenario:

You have the following cash flows:

| Year | Cash Flow |

|---|---|

| 0 | -5000 |

| 1 | 2000 |

| 2 | 3000 |

| 3 | 4000 |

The discount rate is 10% (0.10).

Method 1: Using the NPV Function

- Enter Data:

- Input cash flows in a column (e.g., B2:B5).

- Enter the discount rate in a separate cell (e.g., E2 = 0.10).

- Formula:

=NPV(E2, B3:B5) + B2- B3:B5 includes future cash flows (Year 1 onward).

- Add the initial investment (B2) manually.

- Result: The NPV will be displayed in the result cell.

Method 2: Manual Calculation with Excel Formulas

If you want more control, calculate the present value of each cash flow manually:

- Enter Data:

- Discount rate in E2 (e.g., 0.10).

- Cash flows in column B.

- Formula for Each Year:

- For Year 1:

=B3/(1+E2)^1 - For Year 2:

=B4/(1+E2)^2 - For Year 3:

=B5/(1+E2)^3

- For Year 1:

- Sum Present Values:

Add the present values of all years and subtract the initial investment.

Tips for Accurate NPV Calculations

- Include All Cash Flows: Ensure all inflows and outflows are listed, including the initial investment.

- Check Discount Rate Format: Use a decimal format (e.g., 10% = 0.10).

- Time Periods Must Align: Ensure cash flows correspond to equal time intervals.

Applications of NPV

- Investment Decisions: Determine if a project meets profitability thresholds.

- Project Comparison: Compare multiple investments to choose the best option.

- Budget Planning: Analyze long-term financial impacts of investments.

Conclusion

Calculating NPV in Excel is straightforward and highly efficient. Whether you’re analyzing investments or planning projects, Excel’s tools make it easy to assess financial viability.

For more Excel tutorials and tips, visit The Coding College and unlock the full potential of your data analysis skills!